New Offering Qualitative Discovery

My Role:

Research scoping

Discussion guide / protocol design

Participant recruiting

Interview moderation

Analysis & synthesis

Phases: Discovery

Duration: 4 weeks

Date: November - December 2022

Background

When I first joined, Block provided an "all-in-one" solution for home renovations. This package offered homeowners everything needed to complete a renovation, such as contractor services, design, permitting and approvals, and project management. However, this service model did not have long-term business viability and was difficult to scale.

The team wanted to identify the services and support homeowners find most valuable during a renovation to inform a more scalable offering that would drive homeowner conversion.

Objective

Uncover the most important homeowner “jobs-to-be done” when undertaking a renovation to inform a new offering for the business.

Approach

I leveraged the jobs-to-be-done (JTBD) framework to structure and synthesize interviews with ~20 converted and churned Block homeowners.

Qualitative Interviews & Job Mapping

Designed and conducted ~20, 45-minute interviews with homeowners that included mapping out and prioritizing their primary jobs and desired outcomes across various phases of a renovation.

Homeowner Snapshots

Summarized individual interviews into homeowner snapshots to socialize with executives and other stakeholders in real-time.

Synthesis & Reporting

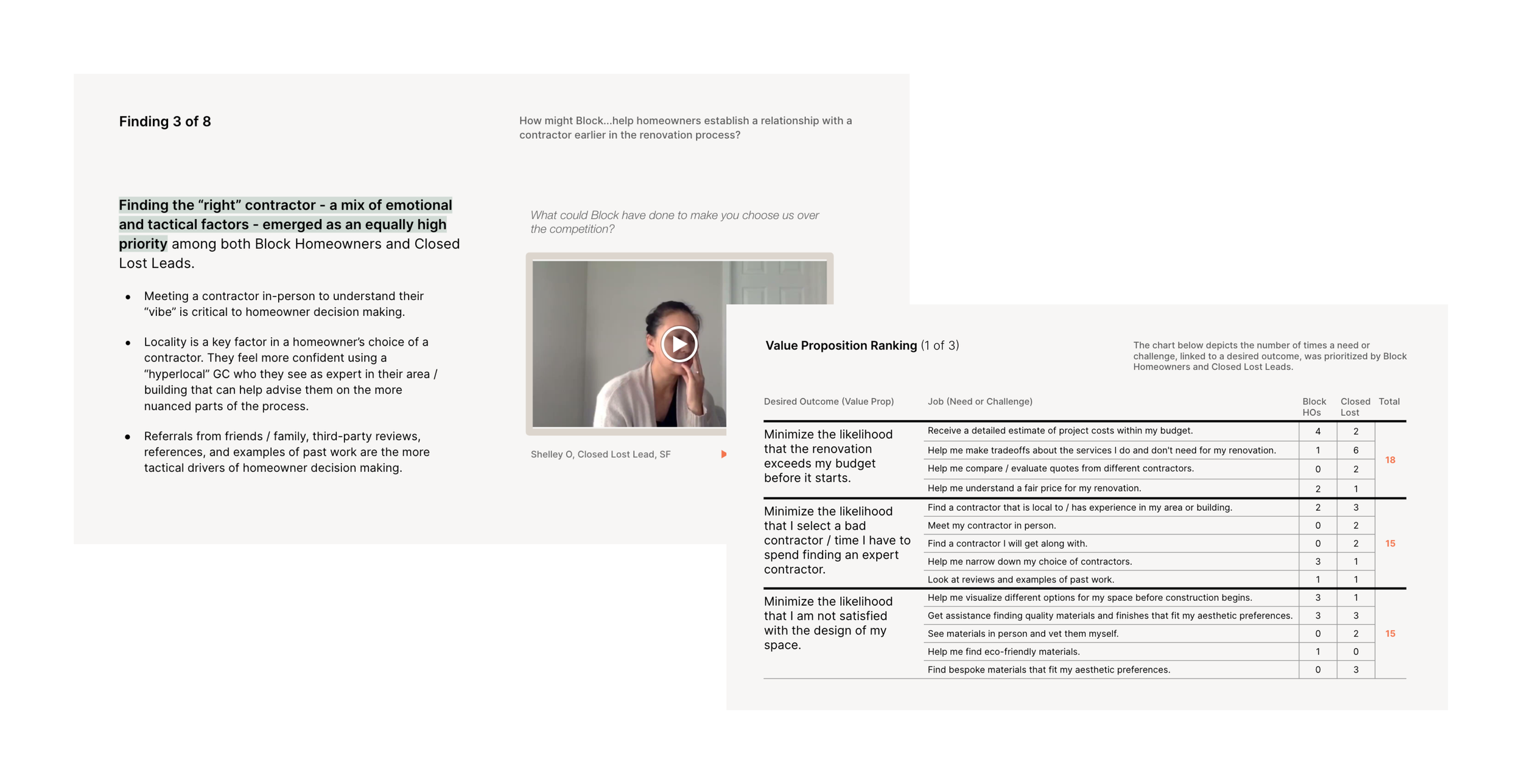

Developed a scoring model to prioritize the jobs and desired outcomes that were most important to homeowners across their renovation journey, specifically uncovering differences in priorities across homeowners who did and did not choose to use Block for their renovation.

Results

Outcome

Through research, I helped Block identify the highest priority homeowner needs when undertaking a renovation.

Impact

The insight that churned homeowners prioritized “minimizing the likelihood that I select a bad contractor” over “minimizing the likelihood I am not satisfied with the design of my space” led Block to recognize they could increase their TAM by de-coupling contractor and design services.

This informed the transition to a new homeowner offering and business model: a contractor marketplace with optional, “add-on” renovation solutions, like design, permitting, and project management.

We then used quantitative research to validate the desirability and viability of this new homeowner offering. See case study here.